|

The Money

Cult

By

Dmitry Orlov

June 09, 2016

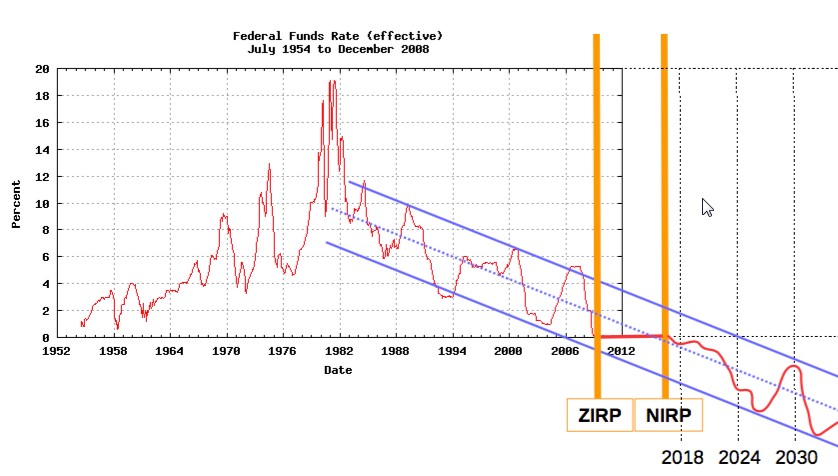

- Previously, I have written about the progression

from positive interest rates to zero interest rates

(since 2008) and finally to negative interest rates.

And I asked my readers a simple question: How will

negative interest rates blow up the financial

system? And apparently none of you knew the answer.

Now, I must confess that to start with I didn’t know

the answer either, which is why I asked the

question, and my first attempts at finding it were

somewhat tentative. But now, having thought about

it, I do seem to have found the answer, and it is

that…

But first let us back up a bit and answer several

preliminary questions:

1. Why did zero interest rates become necessary?

2. Why are negative interest rates now necessary?

and,

3. Why are negative interest rates a really

excellent idea?*

* if you ignore certain unintended consequences

(which is what everyone does all the time, so let’s

not worry about them just yet).

1. Interest rates went to zero because economic

growth went to zero. If you are just now wondering

why that happened, just google “Limits to Growth”

by clicking this link. (A public notice about

the scheduled end of growth has been on display at

your global planning office for four decades now. It

is not anyone else’s fault if people of this planet

don’t take an interest in their global affairs. I

mean, seriously…)

Interest rates and rates of growth are related: a

positive interest rate is little more than a bet

that the future is going to be bigger and more

prosperous, enabling people to pay off the debts

with interest. This is an obvious point: if your

income increases, it becomes easier to repay your

debts; if it stagnates, it becomes harder; if it

shrinks, it eventually becomes impossible.

Yes, you can nitpick and split hairs, and claim that

there was still some growth, but in the

developed economies most of this growth has been in

financial shenanigans, fueled by an explosion in

debt, and most of the benefits of this last bit of

growth accrued to the wealthiest 1%, and did next to

nothing for anyone else. Did this growth help

support a large, stable and prosperous middle class?

No, it didn’t.

In fact, wages in the US, which was once the world’s

largest economy, have been stagnant for generations.

In response, the Federal Reserve has been

continuously reducing interest rates, until they hit

zero in 2008. And there they have stayed ever since.

But now, it turns out, that’s not good enough. If

the Federal Reserve wants to keep the party going,

they have to do more, because…

2. Once you are faced with a continuously shrinking

economy, just holding interest rates at zero is not

sufficient to forestall financial collapse. The

interest rates must go negative.

Here are just a couple of particularly striking

examples.

Australia has amassed a huge pile of debt—over 120%

of GDP—and most of it is mortgage debt on overvalued

real estate. Now that Australia’s economy, which was

driven by commodity exports to China, has tanked, a

lot of this debt is being turned into interest-only

loans, because Australians no longer have the money

to repay any of the principal. But what if they

can’t make the interest payments either? The obvious

solution is to refinance their mortgages as

interest-only at zero percent; problem solved! Of

course, as conditions deteriorate further, the

Australians will become unable to afford taxes and

utilities. Negative interest rates to the rescue!

Refinance them again at a negative rate of interest,

and now the banks will pay them to live in their

overpriced houses.

Another example: energy (oil and gas) companies in

the US have accumulated a fantastic pile of debt.

All of this money was sunk into developing marginal

and very expensive resources such as shale oil and

deep offshore. Since then, energy prices have

fallen, making all of these investments unprofitable

and dramatically reducing revenue. As a result,

energy companies in the US are a few months away

from having to spend their entire revenue on

interest payments. The solution, of course, is to

allow them to roll over their debt at zero percent,

and if you want them to ever start drilling again

(their production has been falling by around 10%

annualized) then please make that interest rate

negative.

3. Are you starting to see how this works? Whereas

before you had to be careful about taking on debt,

and had to have a plan for how you will repay it,

with negative interest rates that is simply not a

consideration. If your debt pays you, then more debt

is always better than less debt. It no longer

matters that the economy continuously shrinks

because now you can get paid just for twiddling your

thumbs!

But are there any unintended consequences of

negative interest rates? Unintended consequences are

hard to think about, and most people get a headache

even trying. How can it be that clean, plentiful

nuclear energy will eventually pollute the whole

planet with long-lived radionuclides, resulting

sky-high cancer rates? How can it be that wonderful

genetically modified seeds will render us sickly and

infertile in just a few generations? And how can it

be that ingenious mobile computing technology has

turned our children into zombies who are constantly

twiddling their smartphones as they sleepwalk

through life? It’s hard to think about any of this

without taking some happy pills; and how can it be

that taking those happy pills has… you get the idea.

The unintended consequence of negative interest

rates is that they destroy money. This is true in an

entirely trivial sense: if you deposit x

dollars at -ρ% annual, then a year later you will

only have x(1-ρ) dollars because xρ

dollars has been destroyed. (In case you prefer to

count on your fingers and toes, if you deposit $10

at -10% annual, then a year later you will only have

$9 because $1 has been destroyed.) But what I mean

is something slightly more profound: negative

interest rates erode the very concept of money.

To get at the reason for this, we have to ask a

slightly more profound question: What is money? I

think that money is the cult of the god Mammon. Look

at the following symbols:

€ $ ¥ £

Don’t they resemble religious symbols? In fact,

that’s what they are: they are symbols of faith in

money. They are also units—dimensionless units, of a

peculiar kind. There are quite a few dimensionless

units in math and science, such as π, e, %,

ppm, but they are all ratios that relate physical

quantities to other, identical, physical quantities.

They are dimensionless because the units cancel out.

For instance, π is the ratio between a circle’s

circumference and diameter; length over length gives

nothing. But monetary quantities do not directly

relate to any physical quantity at all. It can be

said that some number of monetary units (let's call

them "yarbles") is equivalent to some number of

turnips, but that, you see, is a matter of faith.

Should the turnip farmer turn out to be an

unbeliever, he would be within his rights to say, “I

am not taking any of your damn yarbles!” or, if he

were a polite turnip farmer, “Your money is no good

here, Sir!”

Of course, if our turnip farmer were to do that,

he’d land in quite a bit of trouble because, you

see, the cult of Mammon is a state cult. You have no

choice but to be a believer, because only by

worshiping Mammon can you earn the money to pay your

taxes, and if you don’t pay your taxes you get

jailed. Nor can you produce money on your own,

because that right is reserved for Mammon’s high

priests, the bankers. Making your own money makes

you a heretic, and gets you the modern equivalent of

being burned at the stake, which is a $250,000 fine

and a 20-year prison sentence.

But it goes beyond that, because the state insists

that just about everything there is must be valued

in units of its money. And the way everything must

be valued is through a mystical legitimizing process

that is central to the cult of money: Mammon’s

“invisible hand” makes itself apparent within the

“free market,” which is Mammon's virtual temple. The

“invisible hand” sets the price of everything as a

mystical revelation and, as with any revelation, it

is beyond criticism. It is a redemptive ritual, in

which people acting out of their basest, most

antisocial instincts—greed and fear—manage, through

Mammon's divine intervention, to serve the common

good. The “free market” is also believed to have all

sorts of miraculous properties, and as with all

miracles it is all a matter of smoke and mirrors and

suspension of disbelief. For example, the “free

market” is said to be “efficient.” But it sets the

price of turnips, and the result is that fully 40%

of the food in the US ends up being wasted. That’s

definitely not efficient.

This sort of inefficiency can be tolerated while

resources are plentiful. Should throwing away 40% of

the turnips cause a shortage of turnips develop,

turnip producers can grow more turnips and sell them

at prices that turnip consumers can still afford.

But when resources are no longer plentiful, this

trick stops working, and what you end up with is

something called market failure. The current

state of the global oil industry is a good example:

either the price is so high that marginal consumers

cannot afford it (as was the case until quite

recently), or the price is so low that the marginal

producers can’t break even (as is the case now).

And so a bout of supply destruction follows a bout

of demand destruction, and then the pattern repeats.

Everybody loses, plus this is terribly inefficient.

It would be far more efficient to appoint some

central planner to calculate the optimum price of

oil once a month. Then all the marginal producers

would jump out the window, all the marginal

consumers would slit their wrists, and equilibrium

conditions would prevail. As the oil supply dwindled

(it is depleting at around 5% per year), some

additional number of producers and consumers would

need to sacrifice themselves for the greater good,

and so on until the last barrel is produced and

burned, leaving whatever producers and consumers

still remained lying in pools of their own blood.

As natural resources dwindle, our faith in the cult

of Mammon is being sorely tested. But what

alternatives are there? Well, there is an even

older, ancient cult that’s based on idolatry: the

worship of precious metals. Gold has some industrial

and aesthetic uses, but it is primarily useful for

making a golden calf for you to worship (or, if you

are former Ukrainian president Viktor Yanukovich, a

golden toilet). Economists tell us that gold is a

“pet rock” or a “barbarous relic,” and they are

right, but what is one to do when there is a

Götterdämmerung (twilight of the gods) going on?

Nature abhors a vacuum, and in a Götterdämmerung

older pagan deities sometimes emerge and demand

virgin sacrifices—such as poisoning entire river

ecosystems by mining gold using mercury, or

squandering prodigious amounts of fossil fuels in

mining, crushing and sifting through millions of

tons of hard rock to get at just 3 parts per million

of gold.

Negative interest rates are Mammon’s

Götterdämmerung. The money cult is bolstered by

the idea that its huge and all-powerful deity will

be even more huge and all-powerful tomorrow; if the

opposite is demonstrably the case, then people’s

faith in it begins to falter and fade. Negative

interest rates are like an icy-cold bath for Mammon,

causing its godhead to shrink a little more with

every dip. People see that, and think, “I don’t want

to worship his shrinking yarbles.” Then they go and

spend their own yarbles on anything they can

find—fallow land, vacant houses, golden calves,

boxes of brass knobs... They don’t bother investing

their yarbles in growing turnips, because what’s the

use of turnips if all you can do with them is sell

them for even more shrinking yarbles?

Negative interest rates are an excellent idea—and

perhaps the only way to keep the financial game

going a bit longer—but, given these unintended

consequences, they are also a terrible idea. The

bankers know that. They want to preserve their

cult’s status, and constantly talk about raising

interest rates. But they haven’t yet, because they

also know that just a small increase will result in

trillions of dollars of losses, triggering

widespread business failures and ushering in the

Greatest Great Depression Ever. This is not a

problem for them to solve; this is a predicament.

They will delay and pray, and make pronouncements

loaded with keywords designed to please the

high-frequency trading algorithms that are in charge

of artificially levitating the “free market” with

judiciously timed injections of “free money.” But in

the end all they can do is act brave, wait for a

distraction and then… run for the exits!

And your job is to make it to the exits before they

do.

Dmitry

Orlov

was born in Leningrad and immigrated to the United

States in the 1970’s. He is the author of

Reinventing Collapse, Hold Your Applause! and

Absolutely Positive, and publishes weekly at the

phenomenally popular blog

www.ClubOrlov.com

. |

Click for

Spanish,

German,

Dutch,

Danish,

French,

translation- Note-

Translation may take a

moment to load.

What's your response?

-

Scroll down to add / read comments

Please

read our

Comment Policy

before posting -

It is unacceptable to slander, smear or engage in personal attacks on authors of articles posted on ICH.

Those engaging in that behavior will be banned from the comment section.

|

| |

|