A Holiday Note to Congress:

Half of Your Country is In or Near Poverty

By Paul Buchheit

December 14, 2015 "Information

Clearing House" -

Recent

reports have

documented the growing rates of

impoverishment in the U.S., and new information surfacing in the

past 12 months shows that the trend is continuing, and probably

worsening.

Congress should be filled with guilt — and shame —

for failing to deal with the enormous wealth disparities that are

turning our country into the equivalent of a 3rd-world nation.

Half of Americans Make Less than a Living Wage

According to the

Social Security Administration, over half of Americans make less

than $30,000 per year.

That’s less than an appropriate average living

wage of $16.87 per hour, as calculated by

Alliance for a Just Society (AJS), and it’s not enough —

even with two full-time workers — to attain an “adequate but

modest living standard” for a family of four, which at

the median is over $60,000, according to the

Economic Policy Institute.

AJS also found that there

are 7 job seekers for every job opening that pays

enough ($15/hr) for a single adult to make ends meet.

Half of Americans Have No Savings

A study by

Go Banking Rates reveals that nearly 50 percent of Americans

have no savings. Over 70 percent of us have less than $1,000.

Pew Research supports this finding with survey results that show

nearly half of American households spending more than they earn. The

lack of savings is particularly evident with young adults, who went

from a five-percent

savings rate before the recession to a negative savings

rate today.

Emmanuel Saez and Gabriel Zucman

summarize: “Since the bottom half of the distribution always owns

close to zero wealth on net, the bottom 90% wealth share is the same

as the share of wealth owned by top 50-90% families.”

Nearly Two-Thirds of Americans Can’t Afford to

Fix Their Cars

The

Wall Street Journal reported on a

Bankrate study, which found 62 percent of Americans without the

available funds for a $500 brake job. A

Federal Reserve survey found that nearly half of respondents

could not cover a $400 emergency expense.

It’s continually getting worse, even at

upper-middle-class levels. The

Wall Street Journal recently reported on a JP Morgan study’s

conclusion that “the bottom 80% of households by income lack

sufficient savings to cover the type of volatility observed in

income and spending.”

The Middle Class Is Disappearing

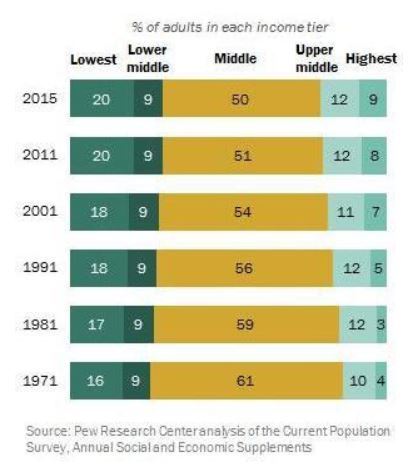

This chart from

Pew Research shows the dramatic shrinking of the middle class,

defined as “adults whose annual household income is two-thirds to

double the national median, about $42,000 to $126,000 annually in

2014 dollars.”

Market watchers rave about

‘strong’ and even

‘blockbuster’ job reports. But any upbeat news about the

unemployment rate should be balanced against the fact that nine of

the ten fastest growing

occupations don’t require a

college degree. Jobs gained since the recession

are paying

23 percent less than jobs lost.

Low-wage jobs (under $14 per hour) made up just 1/5 of the jobs

lost to the recession, but accounted for nearly 3/5 of the jobs

regained in the first three years of the recovery.

Furthermore, the official 5%

unemployment rate is nearly 10% when short-term

discouraged workers are included, and

23% when long-term discouraged workers are included. People are

falling fast from the ranks of middle-class living. Between 2007 and

2013 median wealth dropped a shocking

40

percent, leaving the poorest half with debt-driven negative

wealth.

Members of Congress, comfortably nestled in bed

with millionaire friends and corporate lobbyists, are in denial

about the true state of the American middle class. The once-vibrant

middle of America has dropped to lower-middle, and it is still

falling.

Paul Buchheit is a college teacher with formal

training in language development and cognitive science. He is the

founder and developer of social justice and educational websites (UsAgainstGreed.org,

RappingHistory.org, PayUpNow.org), and the editor and main author of

"American Wars: Illusions and Realities" (Clarity Press). He can be

reached at paul@UsAgainstGreed.org.